On Productivity, Canada is Falling Behind

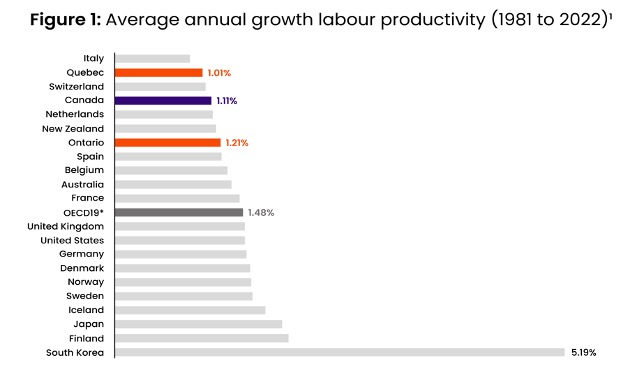

Canada’s capital investment has fallen far behind that of other industrialized countries. As a result, our businesses are less competitive and our workers are less productive. In a dynamic global economy, we need more capital investment to keep our economy growing.

Capital investments boost the economy over the short term while laying the foundation for long-term growth. Investments in facilities, equipment, machinery, and tools, including IT infrastructure, are vital to supporting Canadian workers. These investments raise output, increase wages over time, and increase tax revenues for the government.

Canada’s productivity problem has persisted across governments and decades, rooted in its unique approach to economic growth and innovation. This is why the CFLA has released a new report, Canada’s Economic Rocket Fuel: How a Switch in Canada’s Financing Paradigm Could Help Solve its Productivity Problem, offering a practical strategy to revitalize Canada’s flagging economy.

Help Small Businesses Get the Financing They Need

The report highlights a critical, often-overlooked factor hampering growth: small businesses' inability to access the financing they need to scale up and drive productivity.

Canadian small and medium enterprises (SMEs) employ over 64% of the workforce but face significant barriers in accessing scale-up capital. This impedes their ability to invest in productivity-enhancing equipment, technology, and infrastructure.

The 2008 financial crisis consolidated Canada’s financial sector, reducing competition and leaving SMEs underserved. Canada has struggled to manage a reliable flow of capital to domestic businesses. From 2014 to 2022, inflation-adjusted total business investment in Canada declined by $34 billion, or 2.3% annually.

Independent Financing and Leasing Companies Can Play a Pivotal Role

Independent financing and leasing companies can play a significant role in addressing Canada’s productivity challenges and economic underperformance compared to peer countries in the OECD. A paradigm shift within Canada’s financial community, especially through promoting indirect lending and supporting independent finance firms, can help unlock Canada’s economic potential.

“Small businesses drive productivity, but they need the right financing tools to succeed,” says CFLA’s President and CEO, Michael Rothe. “These Canadian SMEs are seeking accessible and adapted financial support, and while Canada’s independent financing and leasing companies are ideally positioned to fill this gap, they do need better support, recognition and integration into the financial system. This report provides a made-in-Canada roadmap to make that happen.”

Drawing lessons from international models, particularly the British Business Bank’s ENABLE program, the report proposes multiple solutions that would help reshape and improve the finance sector’s role in improving Canadian productivity.

Key recommendations include:

- Expand the Business Development Bank of Canada’s (BDC) indirect lending portfolio to ensure more financing reaches SMEs.

- Introduce securitization programs that bundle SME loans to reduce risk and attract private investment.

- Strengthen partnerships between independent financing and leasing companies and major financial institutions to foster a more competitive, agile and innovative financial ecosystem.

Downloads

Canada’s Economic Rocket Fuel: How a Switch in Canada’s Financing Paradigm Could Help Solve Its Productivity Problem, Report, 2025 [pdf]